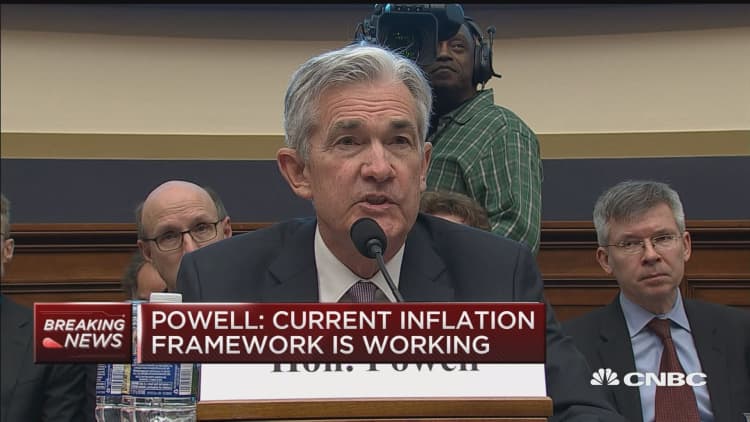

Bond yields rose to the highs of the day as Federal Reserve Chair Jerome Powell laid out a case where the Fed could raise rates more than it has forecast.

"At the December meeting the median participant called for three rate increases in 2018," Powell said Tuesday in response to a question during his testimony to the House Financial Services Committee. "Since then, what we've seen is incoming data that suggests a strengthening in the economy and continuing strength in the labor market. We've seen some data that in my case will add some confidence to my view that inflation is moving up to target. We've also seen continued strength around the globe. And we've seen fiscal policy become more stimulative."

But he emphasized this does not mean the forecast will be upgraded. "So I think each of us is going to be taking the developments since the December meeting into account and writing down our new rate paths as we go into the March meeting, and I wouldn't want to prejudge that," he said, in comments before the House Financial Services Commitee.

Treasury yields rose after Powell's comment just around 10:43 a.m. ET. Yields move opposite price. The 10-year jumped to 2.91 percent. The , the most reflective of Fed policy, briefly rose above 2.27 percent but was back to 2.26 percent.

"The market started reacting to the suggestion that the path [of rate hikes] could be shifting higher, based on all the positives mentioned by Powell," said George Goncalves, head of fixed income strategy at Nomura.

Stocks were under pressure as rates rose, and the dollar also moved higher. The dollar index rose above the key 90 level. That put pressure on gold futures, which fell 1.2 percent.

The Fed's inflation forecast is presented in a chart that has been termed, the "dot plot," with each Fed official's targets for the fed funds rate. The chart for this year is currently showing three interest rate hikes, and the fed funds futures market is also reflecting the potential for three rate hikes.

Markets, however, have become anxious about the idea that there could be more hikes. Many economists are already forecasting a fourth hike for this year.

"It seems to imply in his mind four hikes are possible, but people could disagree with him and that could just be his opinion," said John Briggs, head of strategy at NatWest Markets. "The implication is there's risk to the forecast by March, but there may not be an actual shift."

JP Morgan's chief U.S. economist Michael Feroli had been expecting four rate hikes this year, and Powell's comments served to reinforce his view.

"Today's comments appear to open the door for others on the Committee to revise their forecast as they see fit, and that Powell himself may be inclined to look for four hikes this year," he wrote in a note. "...We now think the odds are tilted slightly in favor of the median participant revising up their outlook to look for four hikes this year and another three hikes next year."